Auto Enrolment

Auto Enrolment

Auto enrolment is a key part of workplace pension reform. It means that employers will have to enrol certain members of staff into workplace pension schemes and make contributions to their pension savings. The Pension Regulator has lots of explanatory guides this article summarises the main points and explains how Keytime Payroll can help with the initial assessment and on-going management of auto enrolment.

Automatic enrolment duties come into force from your staging date - click here to find out your staging date. Automatic enrolment duties affect all employers who:

- employ staff between the ages of 16 and 74

- employ staff in the UK

- deduct tax and NI contributions from salaries and wages

Pension Schemes

Having decided that auto enrolment applies to you the first thing to do is to think about a pension scheme.

If you already have a workplace pension scheme in place you will need to assess it and ensure it meets the criteria for a qualifying scheme. If you don't have a scheme in place you will need to find something suitable. It is important to begin this process early (more than a year in advance if possible) to avoid lack of choice and administrative delays as your staging date approaches. The Pension Regulator has more information on choosing pension schemes and assessing the suitability of existing ones.

Assessing the workforce - who must be automatically enrolled and who has the right to opt in or join?

Assessing the workforce is an important aspect of the enrolment process. The first thing you will need to do is identify who is a worker and of those workers who is a jobholder. A worker is:

- an employee

or

- someone who has a contract to perform work or services personally that is not undertaking work as part of their own business

A jobholder is defined as:

A worker who:

- is aged between 22 and 74

- is working or ordinarily works in the UK under their contract*

- has qualifying earnings*

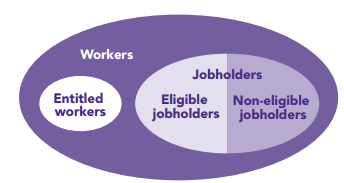

Having identified jobholders the second stage is to identify jobholders that must be automatically enrolled. Jobholders are divided into 2 groups - eligible and non-eligible.

Eligible jobholder:

- is aged between 22 and state pension age

- has qualifying earnings above the earnings trigger* for automatic enrolment

Non-eligible jobholder:

- is aged between 16 and 21 or state pension age and 74

- has qualifying earnings above the earnings trigger for automatic enrolment

or

- is aged between 16 and 74

- has qualifying earnings below the earnings trigger for automatic enrolment

There may be workers that are neither eligible or non eligible jobholders but may ask to join the pension scheme - these are entitled workers. An entitled worker is someone who:

- is aged between 16 and 74

- is working or ordinarily works in the UK under their contract

- does not have qualifying earnings

Changes in age and earnings may see workers move between categories. It is important therefore to regularly monitor age and earnings in order to remain compliant with the rules.

The diagram below demonstrates the different categories of workers:

Here is a summary:

Eligible jobholders - must be automatically enrolled into a qualifying scheme and the employer must make pension contributions

Non-eligible jobholders - do not have to be automatically enrolled but may ask to opt in to a qualifying scheme. The employer must make pension contributions

Entitled workers - do not have to be automatically enrolled but may ask to join* a scheme (doesn't have to be qualifying). The employer is not obliged to make pension contributions

*Note that entitled workers can join a scheme - there is a difference between joining and opting in. Those that are automatically enrolled or opt in have opt out rights (see below). Entitled workers that join a scheme can cease membership but do so under the scheme rules.

The Pensions Regulator has detailed guidance on employer duties and assessing the workforce click here to obtain the guide.

*Qualifying earnings - earnings at or above £5668 and below £41150 (tax year 2013/14) in other words the upper lower earnings limits for NI (pro rata to the pay reference period)

*Earnings trigger - earnings at or above £9440 (tax year 2013/14) in other words the tax threshold (pro rata to the pay reference period)

Important note: The Pensions Act 2008 defines earnings as:

- salary wages commission bonuses and overtime;*

- statutory sick pay under Part 11 of the Social Security Contributions and Benefits Act 1992 (c. 4);

- statutory maternity pay under Part 12 of that Act

- ordinary statutory paternity pay or additional statutory paternity pay under Part 12ZA of that Act;

- statutory adoption pay under Part 12ZB of that Act

*Note that salary and wages may include items other than regular weekly or monthly pay items such as car or clothing allowance may need to be considered. Refer to contracts of employment or take legal advice if you are unsure.

Pay Reference Period

An important aspect to assessment is ascertaining pay in the relevant pay reference period (eligible jobholders must have qualifying earnings at or above the earnings trigger in the pay reference period). A pay reference period is simply the period of time by reference to which the employer pays the worker their regular wage e.g a week for weekly paid employees a month for monthly paid employees.

Worker assessment is based mainly on two things: age and earnings. The initial assessment is carried out at the staging date (or at the end of the postponement period). Employers with a steady monthly paid workforce with pay elements that don't fluctuate should find the process simple and straightforward. Employers with weekly paid staff with pay elements that fluctuate will find it a little more challenging. The window for assessment and enrolment for the latter type of employer will be small - a full assessment cannot realistically take place until the pay period that coincides with the staging date is open and the elements of pay for the period have been captured. In addition there is the need to assess every pay period as workers may need to be enrolled.

Payroll software can help with some of the on-going challenges (flagging up new starters and employees who have reached the earnings trigger in the pay period and producing output files for pension companies) but it will ultimately fall to the employer to ensure compliance and to communicate the correct information to employees at the right time.

Informing Staff about Automatic Enrolment

Once you have determined that automatic enrolment applies to your workforce you will need to tell your staff about it. You must write to each member of staff to tell them how automatic enrolment affects them and about their rights. The Pensions Regulator has full details click here to find out more.

Postponement

You can choose to postpone enrolment for some or all of your staff for a period of up to three months. You can only use postponement in certain circumstances and from specific dates:

- from your staging date (note that postponement does not change your staging date)

- a staff member's first day of employment

- the first day a member of staff becomes eligible for auto enrolment

You might use postponement as a policy for all new members of staff or temporary workers who aren't going to be employed for longer than three months (the maximum length of time you can postpone). You may also use postponement to handle pay spikes for members of staff who would not ordinarily qualify for auto enrolment for example where a one off bonus or payment takes someone over the earnings trigger in a pay period.

If a member of staff qualifies for auto enrolment the day after a period of postponement ends you cannot postpone for a second time; they must be enrolled.

You must write to all employees informing them of postponement within one month of the postponement period start date.

Further details can be found on the Pensions Regulator's website.

Opting Out

Staff who have been automatically enrolled or those who have opted in may choose to opt out of the pension scheme (note that opt out rights do not apply to entitled workers who have joined). The rules for opting out are as follows:

Before a staff member can opt out of a scheme they must have become an active member under the opt in or automatic enrolment provisions. They must also have been given enrolment information by the employer. If the staff member wishes to opt out after being given details of the scheme they can do so by giving the employer an opt out notice within the opt out period.

The staff member usually obtains the opt out notice from the pension scheme provider. On receipt of the opt out notice the employer must cease all pension deductions and take immediate steps to opt them out of the scheme. Any contributions must be repaid within one month of the opt out notice being received (do not wait for refunds from the pension company or you risk missing the deadline).

The opt out period

For occupational pension schemes the opt out period begins from the later of the date the staff member:

- becomes an active member of the scheme (i.e. the date administrative steps for achieving active membership are completed) or

- is given written enrolment information

For personal pension schemes the opt out period begins from the later of the date the staff member:

- is given the terms and conditions of the agreement to become an active member or

- is given written enrolment information

The Pension Regulator has detailed guidance on opting out with practical examples of how to work out the out out period click here to obtain the guide.

Automatic Re-enrolment and Cyclical Re-enrolment

Automatic re-enrolment

You may encounter a situation where an eligible jobholder (one who has been automatically enrolled) ceases to become an active member of the scheme (under the rules of the scheme) but hasn't opted out for example where they ceased to have qualifying earnings or they no longer work or ordinarily work in the UK. In these circumstances the employer must monitor the jobholder and automatically re-enrol them once the criteria to automatic enrolment is met. The process for automatic re-enrolment. i.e. writing to the jobholder opt out entitlement etc. is the same as that set out in law for automatic enrolment.

Cyclical automatic re-enrolment

Cyclical automatic re-enrolment occurs roughly every three years after the employers staging date the process is broadly the same as that carried out at staging. The main points are:

- The employer does not have to reassess the entire workforce; only those that have voluntarily opted out or ceased active membership of a qualifying scheme more than twelve months ago.

- Anyone meeting the criteria of eligible jobholder and who hasn't opted out within the last twelve months must be automatically re-enrolled on that date.

- Postponement cannot be used with automatic re-enrolment (cyclical or otherwise); automatic re-enrolment must take place with effect from that date.

- The employer may choose the cyclical re-enrolment date but it must be within a six month window starting three months before the three year anniversary of the original staging date and ending three months after.

Click here to read the detailed guidance on automatic and cyclical re-enrolment.

How will Keytime Payroll Help with Auto Enrolment?

From April 2014 Keytime Payroll will feature auto enrolment functionality. You will be able to:

- Run an initial assessment of the workforce and opt in workers you know will meet enrolment criteria (saves waiting until the pay period is open)

- Automatically assess workers in each pay period; payroll will flag up workers that meet the criteria for enrolment

- Option to postpone company wide (at staging date) or at worker level

- Handles cyclical re-enrolment

- Pay elements can already handle pensionable pay from April you will be able to state that they contribute to qualifying earnings too

- Set up pension schemes to handle pension contributions based on the qualifying earnings threshold or all earnings

- Set up multiple pensions to handle multiple tiers in the same scheme

- Output files for common schemes with flexible option to generate your own

- Reports dedicated to pensions and enrolment

To discuss how Keytime Payroll can help you with auto enrolment please contact us on 0161 484 3500 or speak to your account manager.